January 2023 Report

2022 – An Interesting and Odd Year

We entered 2022 hot so it feels like we are leaving it cold. That is how rapid shifts affect us psychologically. If you’ve been sitting in a hot tub for an hour and you get out you might think it’s freezing cold outside, when it’s a relatively warm 93F. The same holds for the real estate market in the last year.

At the beginning of 2022, we had 2 months of inventory, which is the second lowest level reached for Lake Las Vegas in a decade, only bested by May of 2021. From there it just kept going down… until the Fed raised interest rates. Buyers stopped looking. Phones stopped ringing. It seemed like a real estate apocalypse out there. But the essential economics of the market didn’t change. By December 2022 the average home price for all of Lake Las Vegas had risen over 25% since the beginning of 2021. At the beginning of 2022, buyers were experiencing FOMO (Fear Of Missing Out). They were afraid that someone with more buying power would out-bid them on a home so they were making above list offers, and/or removing important contingencies. Suddenly, mortgage interest rates spiked and buying power was deflated. Already exhausted buyers just quit. Some buyers already had to stretch well beyond their comfort zone to budget for a home purchase, rapidly growing mortgage rates pushed them well past their acceptable budget. It didn’t help that the stock market had tumbled on several occasions and inflation didn’t seem to slow down. Buyer’s got the signal, they suddenly understood that there is no reason to rush into a purchase and plenty of reason to wait for the market to bottom.

Robin and I have a live feed of real estate activity here in Lake Las Vegas. Every new listing, listing put under contract, price reduction or closing hits our radar the second it it is pushed to the MLS. We saw price reductions at first, followed by withdrawn listings, or listings that were put up for rent. Inventory piled up, but mostly because homes were not selling. New listings were not coming online very often, in fact, they had slowed down. So where are we now, and where are we headed? Let’s review where we are now first.

Lake Las Vegas by the Numbers

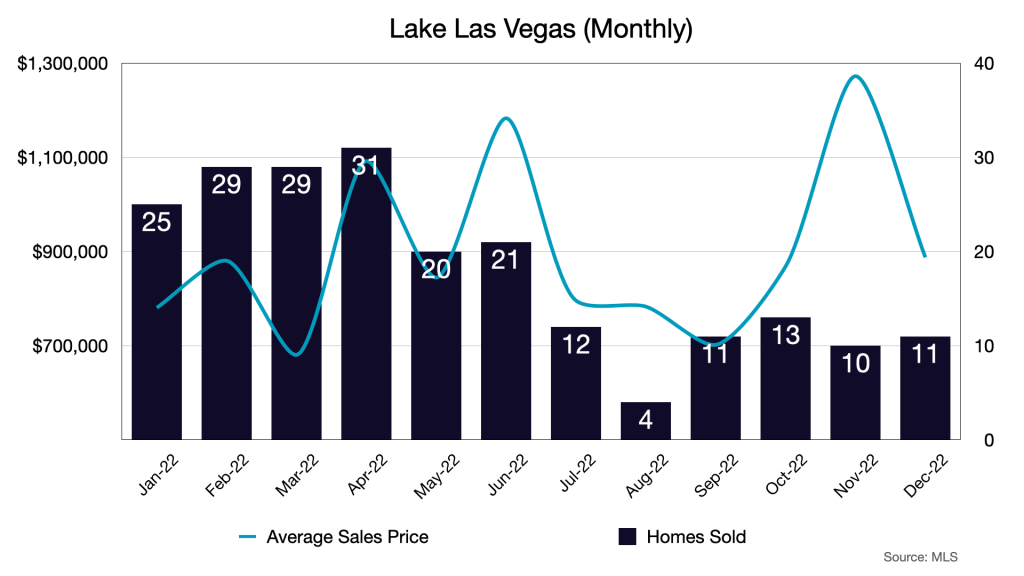

We broke the downward trend in sales activity, which bottomed out in August, but we still ended the year quite low. Keep in mind that the winter months tend to be slower in general. Please note that some of the average price volatility may be due to this low sales volume.

Although considerably fewer new listings came on the market in the second half of 2022, inventory began to pile up due to the slowdown in sales volume. We are starting to see more sales activity and the reduction in inventory towards the end of 2022 may be the start of a trend, though we may not see this accelerate until the spring when market activity usually picks up.

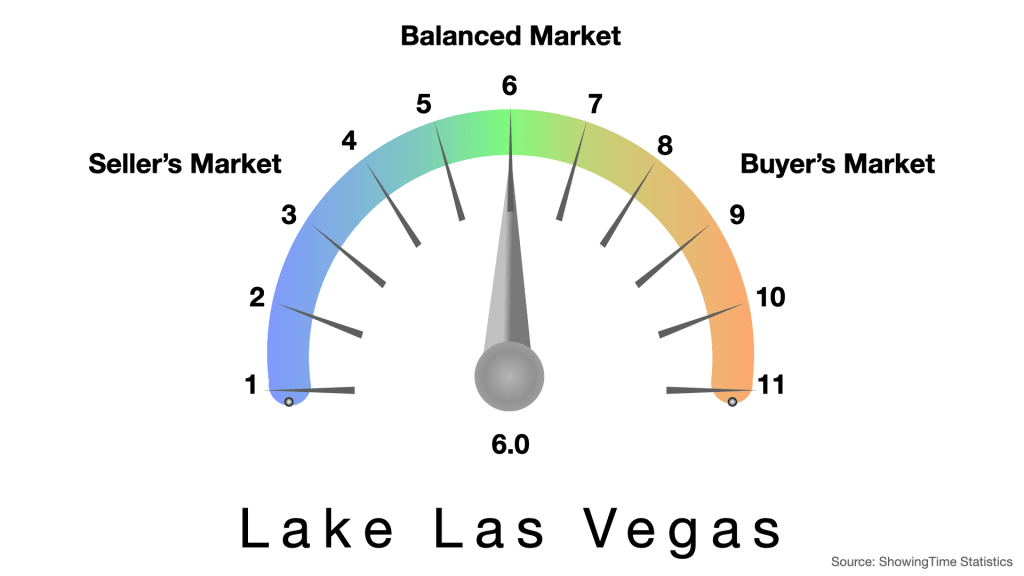

At the beginning of 2022, Lake Las Vegas was in a strong seller’s market with less than 3 months of inventory. We peaked in November at 6.9 and the recent sales uptick has brought us back to a balanced 6 months of inventory.

Pending Sales is a forward looking indicator. Most pending sales close within 30 – 45 days of acceptance. We should see another reduction in inventory assuming listing activity does not grow faster than sales.

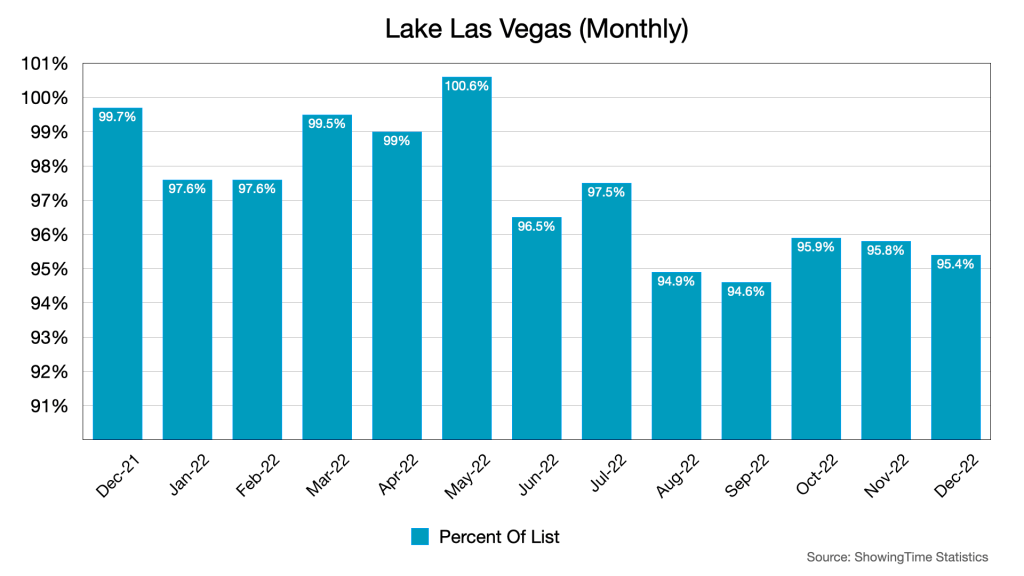

The shift away from a seller’s market can be shown in the offers. Accepted offers have been about 4% lower than list for the second half of 2022.

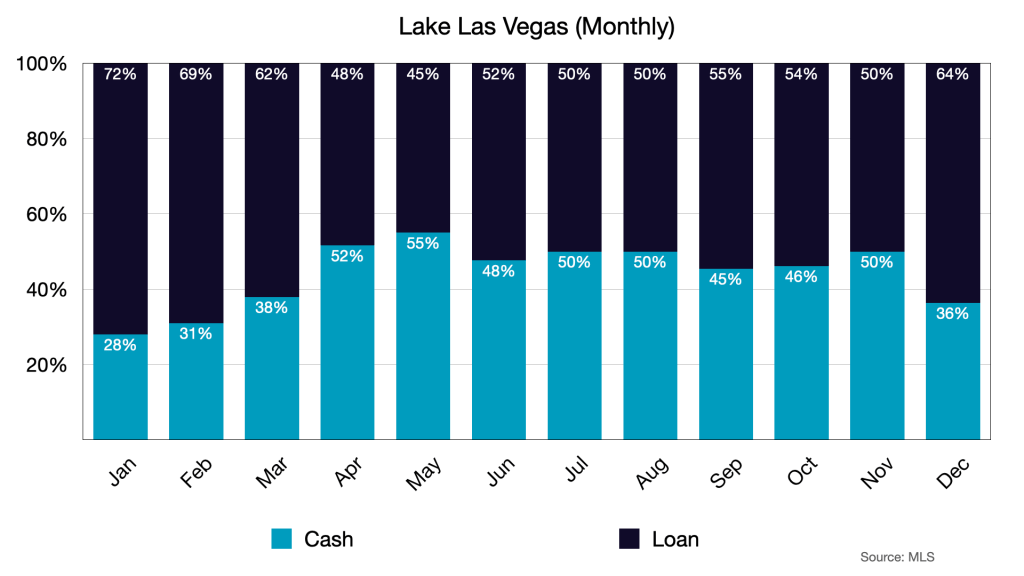

From 2009 to 2018, the Lake Las Vegas market was dominated by cash buyers with a peak of 76% of transactions being in cash*. The low interest rates of the latter years enticed some of those cash buyers to consider taking a low interest loan so they didn’t have to take too much out of their portfolio to buy a home. With rates going up, we are starting to see more cash entering the market. We’ll continue to watch this to see if it becomes a trend or if this is just normal variance.

*Cash transactions include non-institutional lending arrangements and other non-traditional transactions, such as Owner Will Carry, 1031 Exchange, Private Lending, Wealth Management Leveraged Accounts and other such arrangements.

For more Lake Las Vegas real estate market data, click on the button below to access our dashboard.

Final Thoughts

As of this writing (1/19/23) there are 24 new listings that hit the market in January making the total active listings 101. So far, 12 listings have gone under contract in January and 4 have closed. This upswing in listing activity suggests sellers are feeling confident in the new year and although pending contracts isn’t quite keeping up pace with listings, it is still a lot more active than in previous months, which suggests buyers are also feeling more confident going into 2023.

Interest rates have pushed some buyers out of the market, or down market. Cash capable buyers too, no longer have the leverage of an institutional loan they might have had in previous years to increase their buying power. The massive losses in the stock market in the early and middle parts of 2022 likely postponed cash or cash heavy purchases. If market confidence continues to improve, we may see an uptick in sales activity in spring and summer 2023.

Cash buyers are returning to the market, albeit at a slow pace. They may need time to get comfortable with the new reality and to realign their portfolios to ensure they can make a purchase comfortably. Non-institutional lending will replace some of the institutional borrowing that wealthy cash capable buyers might have used because they are now competitive with institutional loans.

We are tracking mortgage rates regularly to see where they are headed. If we see them stabilize or better yet, drop into the 5% range, we think this will add to buyer confidence. Unless some other economic conditions force home owners to sell at a discount, it is unlikely that inventory is going to increase significantly, which means home prices will remain stable, or at least they won’t drop significantly. In short, we are in a balanced market and there is little reason to believe it will swing one way or the other. A balanced market is a healthy market. Seller’s can take advantage of the growth they saw in the past few years, and buyers have some room to negotiate given the slowed pace of sales.

I invite you to leave your thoughts in the comments below.

Thank you,

Robin & Dave

Sign up for our monthly newsletter below.

3 thoughts on “Lake Las Vegas Market Update”