February 2023 Report

2023 Trends Coming Into Focus

Before we get into it, I’d like to thank you for following our market reports. These reports serve two purposes. They are intended to keep you informed, but they also serve as a way for me to digest the information I am tracking on a regular basis. Not all of the news and information ends up in this report, but it is nonetheless baked into the opinions and thoughts expressed. For me, writing this report helps me figure out what information is important and what is just noise. I hope it helps in how you think about real estate data in general.

Now, onto the matter at hand. In the January report, we had identified some potential emerging trends in the market. Those trends include some early indicators of buyer confidence as well as seller confidence. Before we dig into the numbers, I would like to remind you that the real estate market is seasonal. Listing and selling activity usually picks up in the spring and summer months and cools down for the winter and fall months. We are still in the trailing weeks of winter so it’s a bit early to draw conclusions as to how the spring market is going to turn out, but we do have some idea of the direction it is headed. As of now, we think it is headed for a moderately active buying season, but there are indicators that inventory may offset the uptick in buying activity. Here is where things stand today.

Lake Las Vegas by the Numbers

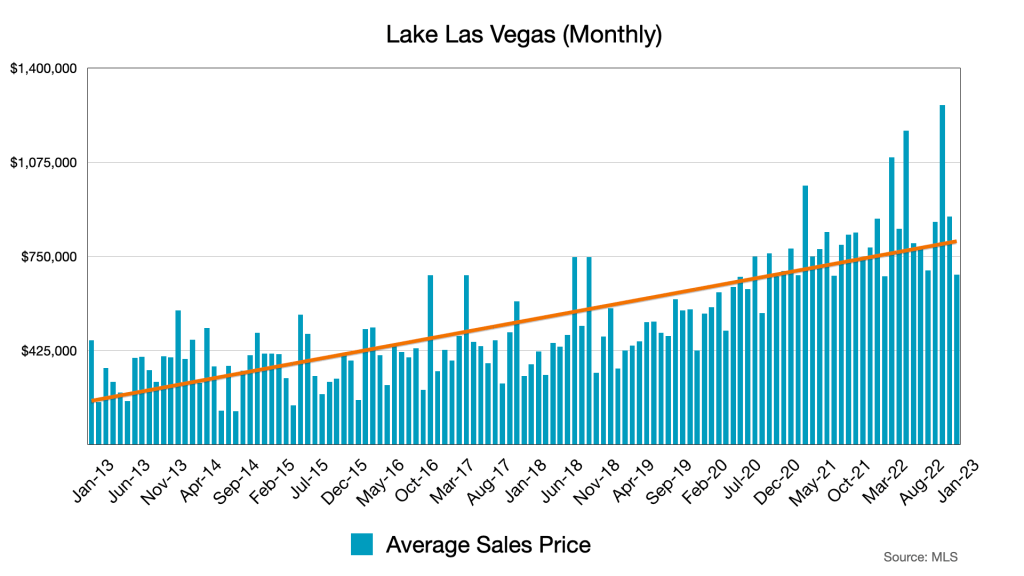

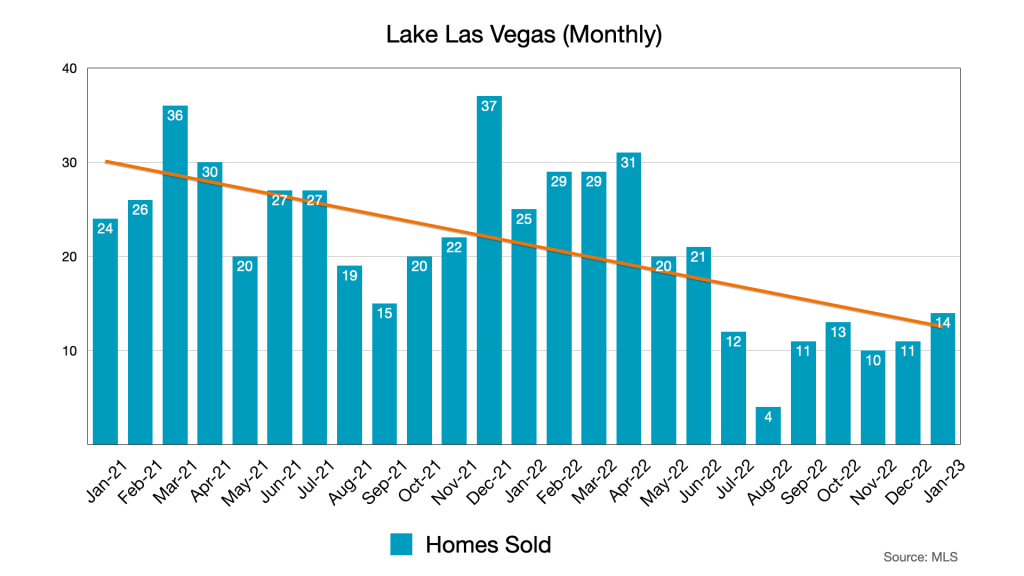

First some long term perspective for context. This is ten years worth of Lake Las Vegas sales data, which you can explore here. The orange line is just a linear trend line. The point is, that most homes in Lake Las Vegas have seen significant gains so the softening that happened in the latter half of 2022 had little impact on those gains.

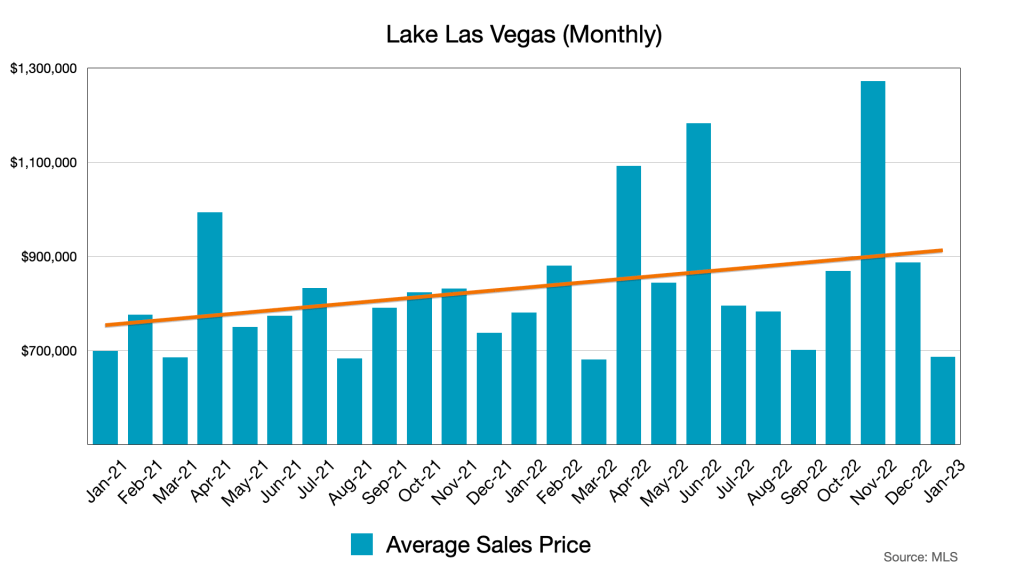

If we zoom into 2021, 2022 and January 2023, you can see that we are still on an upward trajectory in terms of price. Note that the second half of 2022 had considerably lower number of sales. November of 2022 is an anomaly because there were a few high dollar value closings that month that skewed the average. You can explore this data in greater detail on our Dashboard so you can see which transactions included in these averages.

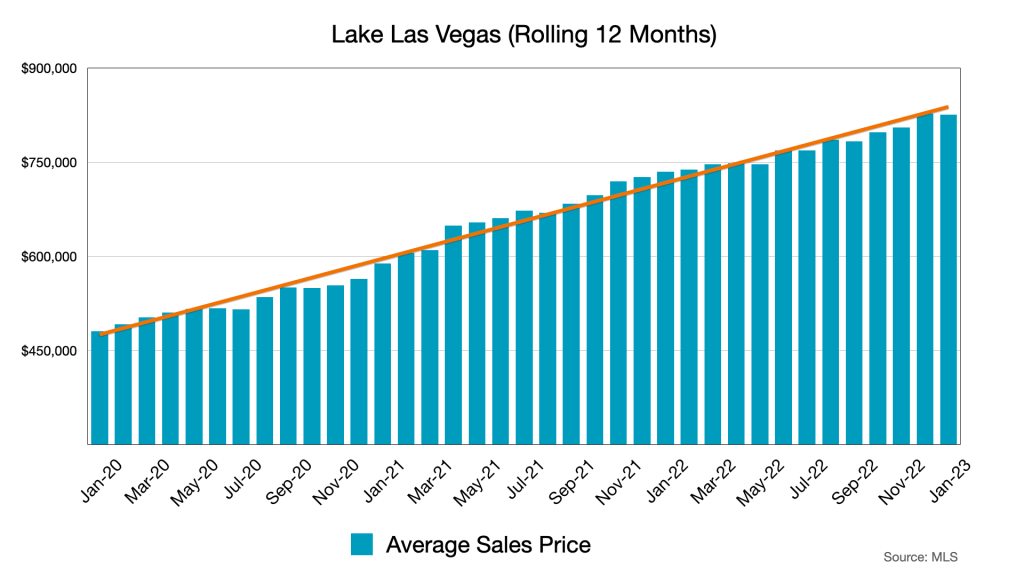

Here we see the average sales price as a rolling 12 month average. This helps reduce the effects of seasonality and unusually large or small sales prices.

It takes about 30 to 45 days to close most sales. Yes, cash sales can close faster, but often do not due to the logistics of the seller’s or buyer’s move and other factors. Here we see transactions that closed in January 2023 going up slightly, which means those homes went under contract in November or December. Mortgage (purchase) applications bottomed by the end of October 2022 and began to rise in November. This is a national number, but it does track with the bump in sales activity that we are seeing today.

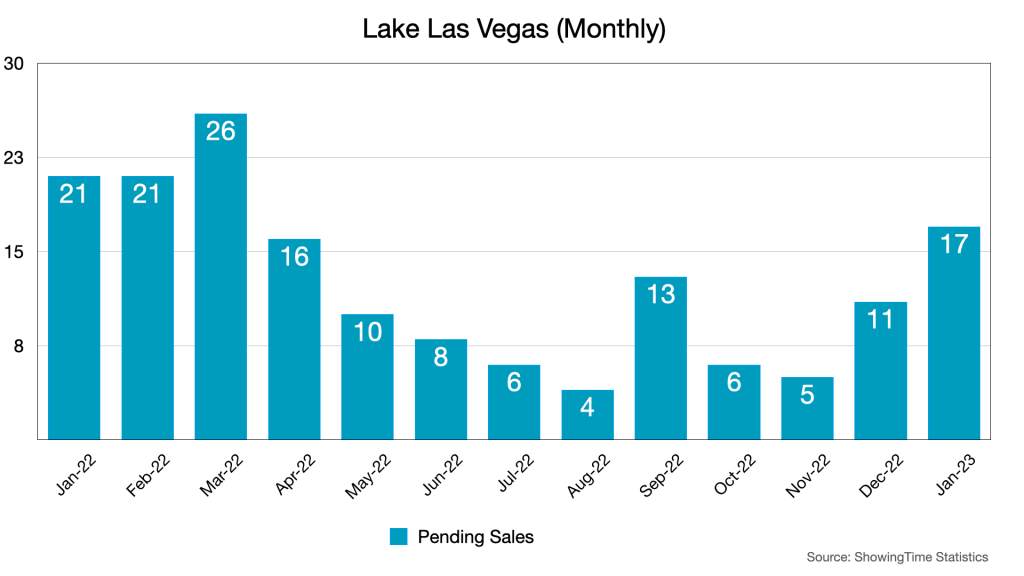

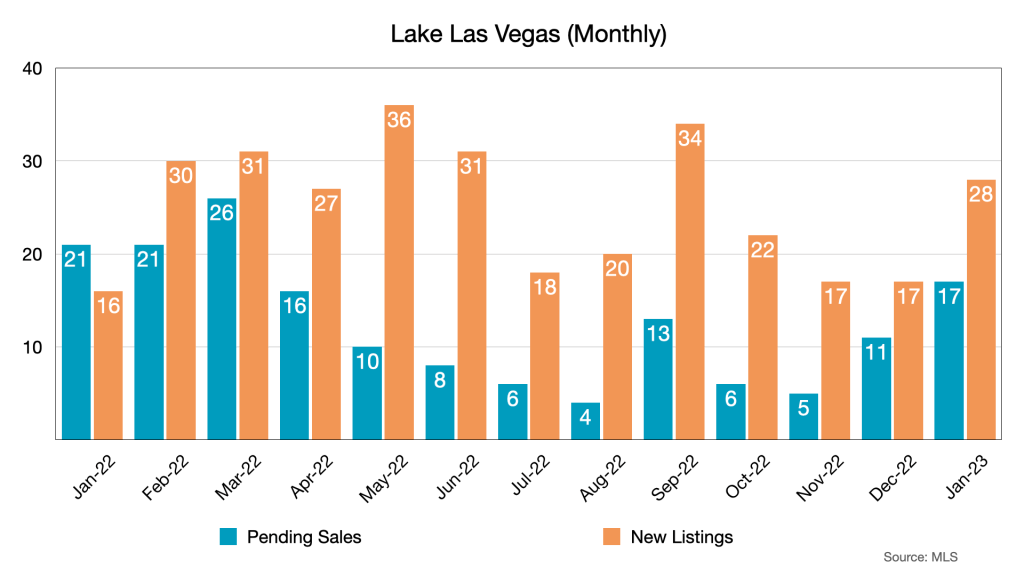

January 2023 had the highest pending sales number since the sudden drop off in April 2022.

But new listings are part of the inventory equation as well. New listings in this case, suggests seller confidence. At this point in time, there are no extreme economic factors that are forcing people to sell. These are sellers who still have a lot of equity built up and feel reasonably confident they will be able to sell at an acceptable price. Sellers are also buyers in most cases, because people have to live somewhere.

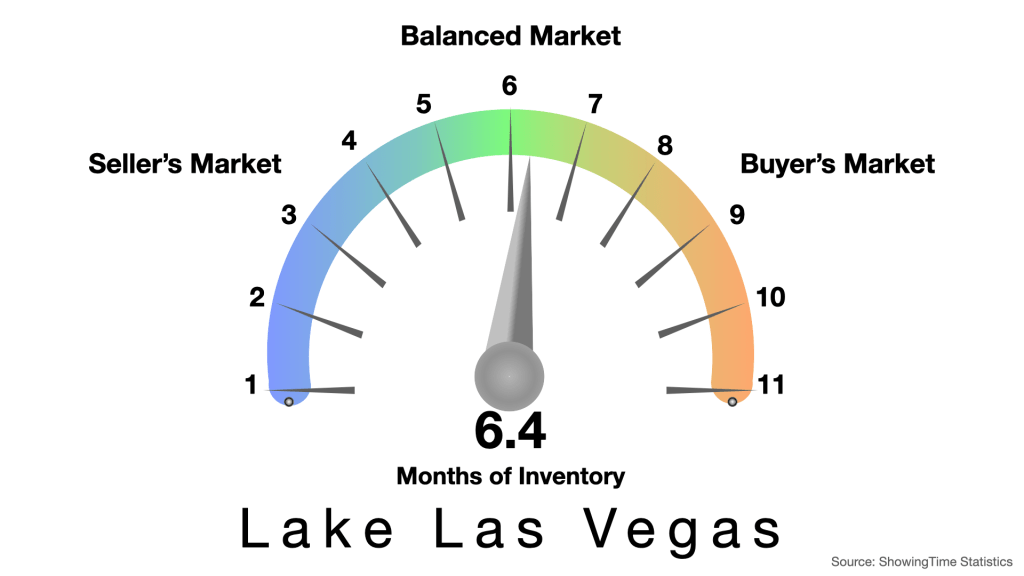

Here is where we are today in terms of inventory. This simply means that assuming no more homes come onto the market, the current inventory will be sold off in about 6 months assuming they keep selling at the current pace. Of course, we should expect new inventory and fluctuations in the pace of selling, but this tells us that we are still in a healthy market even though for now, listings seem to be out pacing buyer demand by a bit.

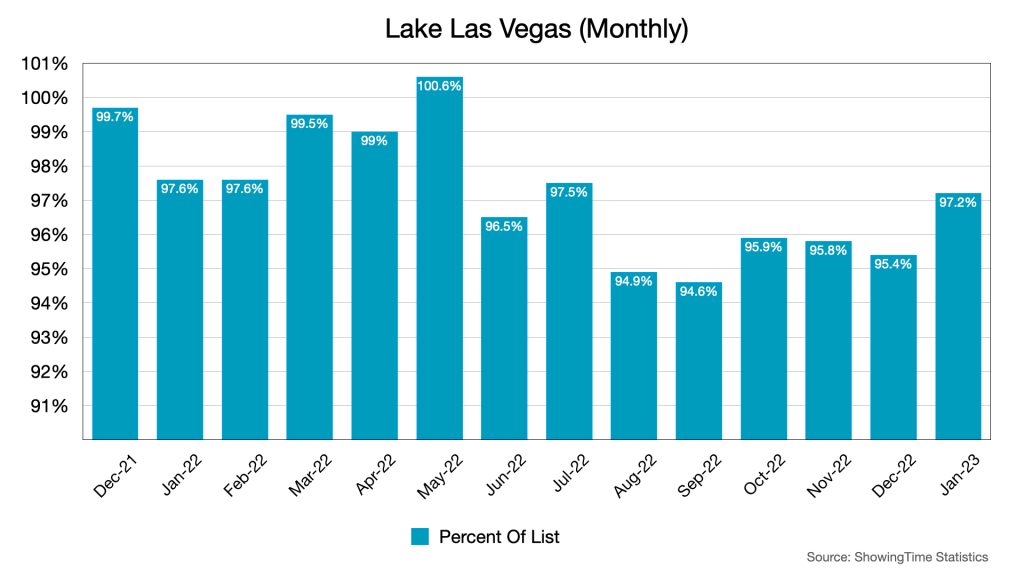

Here is some good news. We’ve broken above the 95% mark in January. So on top of more homes selling and going into contract, we are also seeing offers that are closer to list. One word of caution though, this is one month of data and it is still a relatively low number of sales we are looking at. This suggests two things. One, list prices have adapted to the new market. We have better comps out there to inform us how much a home ought to sell for so we are getting it closer to reality now. Two, buyers have access to those same comps and feel comfortable accepting a counter offer knowing they are getting a fair price.

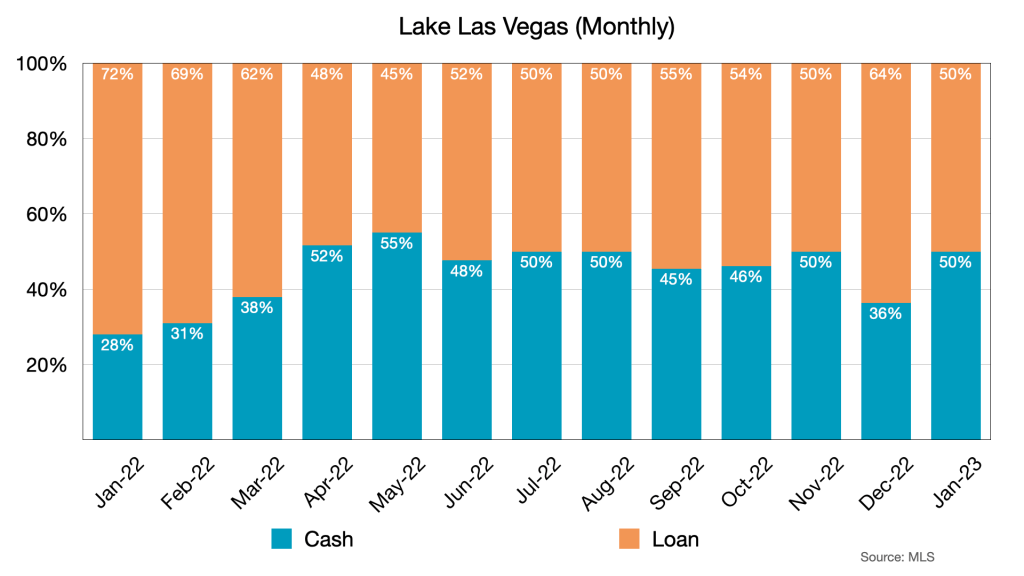

Cash buyers are still a significant portion of the market. Despite a recent Fed rate hike, interest rates have come down and seem to be stabilizing in the low 6% and in some cases the mid to high 5% range. Interest rate stability is an important factor for buyer confidence. We are already seeing another bump in mortgage (purchase) applications similar to the one we had in November.

For more Lake Las Vegas real estate market data, click on the button below to access our dashboard.

Final Thoughts

January 2023 represents a healthy rebound from the doldrums of the latter half of 2022. The spring market will likely bring more buyers and sellers into the market. Home prices will likely remain stable in the coming months.

We are watching two national level stats, interest rates and mortgage (purchase) application data to see how many potential buyers are coming into the market in the 30 – 90 days following the data. To get a good grip on interest rates, we follow two other indicators, the 10 Year Treasury note yield and the price of mortgage backed securities (MBS). When the MBS market is weak, lenders tend to raise interest rates and conversely, when they are strong, they tend to lower interest rates.

The big picture economic indicators like employment, GDP, debt and inflation tend to be less reliable for knowing where a highly localized housing market like Lake Las Vegas is headed, but nonetheless, they impact national and often international markets so they are still important to watch. One of the reasons I am tracking the cash vs. loan buyers is because cash buyers tend to be people who have enough accumulated wealth and income to weather these larger economic storms when they happen. They are often the first buyers to come into the real estate market when opportunity presents itself. In my opinion, the recent softening of home prices, a balanced 6 months of inventory and indicators that the local market has stabilized from the 2022 slowdown all represent potential opportunity for cash buyers. Keep in mind that according to the Credit Suisse Global Wealth Databook, global personal wealth grew 13% last year, and is projected to keep growing through 2026. This means that the number of cash capable buyers is growing.

With the above global trends in the growth of high net worth individuals in mind, we have to also remember that strong tourist demand and a quality tourism board often correlate to a strong inflow of potential high-net-worth international buyers. Las Vegas is a popular tourist destination and Lake Las Vegas has all of the important ingredients many of these buyers are looking for.

I invite you to leave your thoughts in the comments below.

Thank you,

Robin & Dave

Sign up for our monthly newsletter below.