April 2023 Report

A Sane Market With Luxe Performance

This is going to be a short post. There isn’t much to cover or analyze that hasn’t been discussed in the last report and nothing much has changed since then. That said, we think this is a good time to reflect on some basic truths about real estate. These truths sometimes get overlooked in the hype and noise of the news and all of the commotion about interest rates and such, so let’s talk about them and why they matter and then we’ll go over the numbers.

Truth #1: Real estate is local. It is so local that even a multi-billion dollar company with advanced pricing algorithms can’t figure out how much your home is worth with a satisfying degree of accuracy. We’re talking about the Z word website that shall not be named. This is why we focus on Lake Las Vegas. You can wander a half mile away from this community and have a completely different housing economy. That and because we live here. Smiley Face Emoji.

Truth #2: Real estate is global. Yes, yes, everyone has to live somewhere, yada yada. Yes, we yada yada’d the idea of basic shelter. This is not what we mean when we say real estate is global. The truth is, because everyone needs it, and because it cannot be moved even a little bit, it has intrinsic value. It is not a commodity like gold, because you can live a decent life without ever touching so much as an ounce of the stuff, but life becomes much less viable if you don’t have shelter. You might be tempted to think that we’re isolated from the global real estate market because your home is where it is and it isn’t going to China any time soon, but China can certainly come to your home. Literally. I’m talking about Chinese home buyers.

Truth #3: Real estate is an investment. So, as a real estate agents, our names and phone numbers are everywhere. We’re fine with this, we want to be found. Our phone numbers are 702-858-8833 and 702-592-0679, call us if you want to buy our sell a home. We get a lot of calls though, some of them from people trying to sell a warranty on a car we haven’t owned since 2007, but many are asking if we have any potential “Flip” homes coming onto the market. We don’t know how these people are making money. We’ll not get into the upside down economics of flips in this market, but we feel bad for the people who call, because our answer is always “no.” We bring up flippers because that is what most people imagine when they hear us say that real estate is an investment. It is more than flipping. Real estate, including residential real estate generally appreciates over the long term. There are dips along the way, so you have to be patient and be able to hold out through those dips, but it usually holds or appreciates in value over the long haul. Some investors collect rent, other’s just buy a five-million dollar vacation home at the lake and sell it when they are ready.

The local market here in Lake Las Vegas has some unique characteristics that cannot be replicated easily. These unique characteristics are attractive to investors, because they are attractive to people looking for a nice place to take shelter from the world. That is the theme here, because all else being equal, not much has changed since last month, but we’ll go through the numbers anyway.

Lake Las Vegas by the Numbers

When we say real estate generally appreciates over time, this chart is what should come to mind. You don’t even have to use Lake Las Vegas to recreate this chart (with different numbers, but the same approximate trajectory), any market will do. This is a 172% appreciation over a decade. Now, before someone from the government gets upset at us, we’ll say that it is not quite so simple as buying and then waiting ten years to make a 172% on your investment. Ask the investors who bought in 2006-2007 what we’re talking about and then duck.

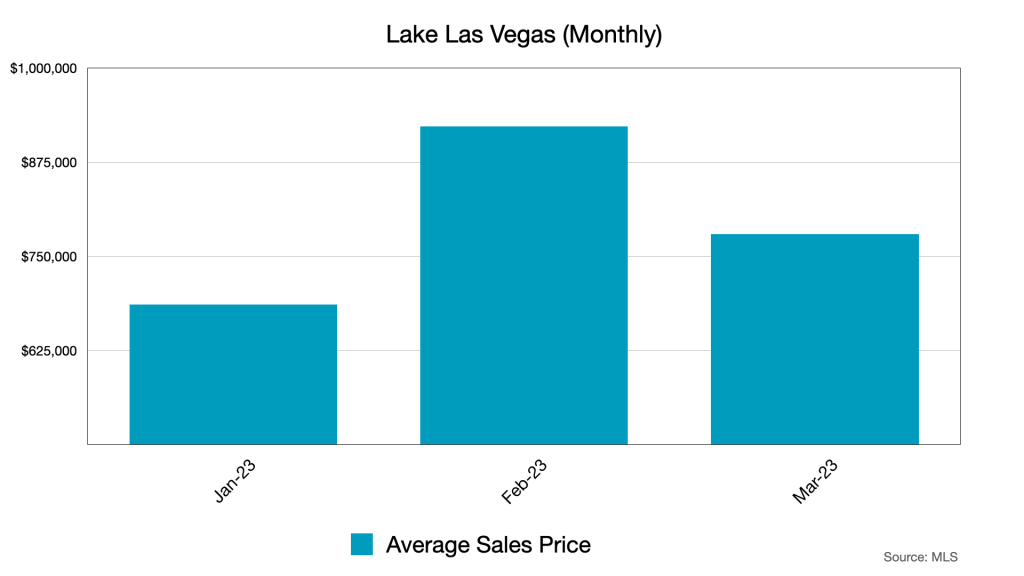

These are the monthly averages for the first three months of 2023. It’s hard to see a trend here because there isn’t one. These are just how the sales of these three months averaged out. Averages are not special, they are just average.

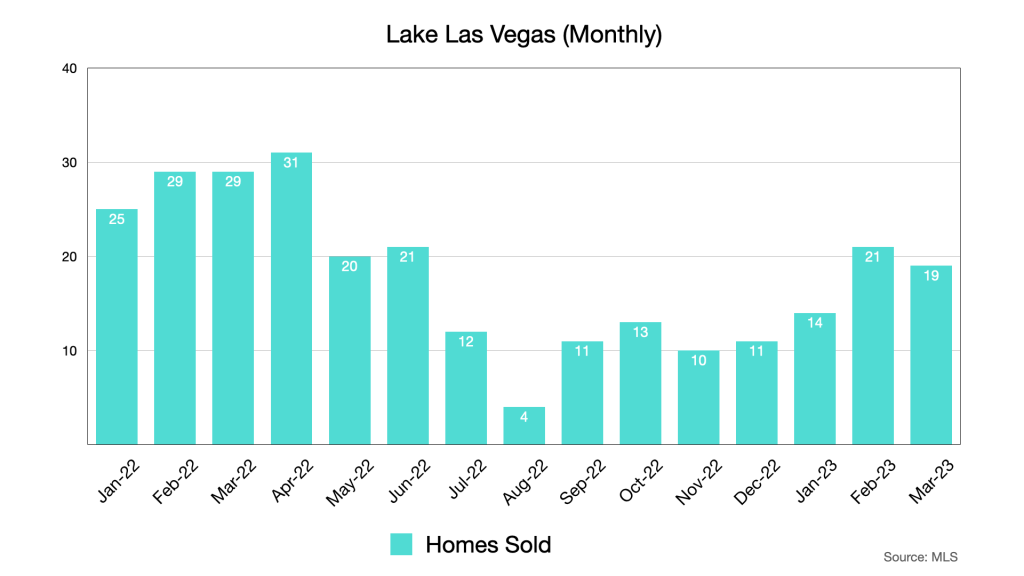

These are the raw sales numbers from the MLS, they are not averages, just numbers. We’re leveling off a bit in sales activity, but this is a stable market. Some of the low volume in the winter months are to be expected due to seasonality of the market, but they are still lower than normal.

Pending sales are still hovering in the high teens and listings, while lower for March, are still outpacing. This isn’t unusual for Lake Las Vegas since the higher than average price point means most homes take longer to sell anyway.

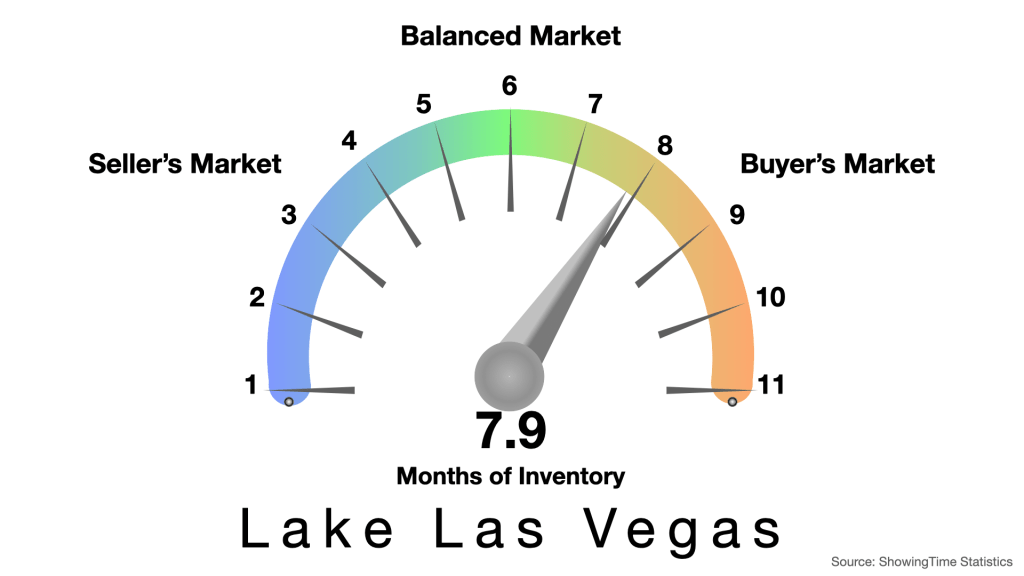

Inventory went up a bit from February’s 7.7 level, but there really isn’t much of a change here. Historically, Lake Las Vegas tends to land in the 7 to 15 month range so we are not in unusual territory here. Some buyers, however may see opportunity on this chart. This is the type of gauge chart their agent is going to show them, or at least attempt to explain to them when they go out looking for a deal.

We linked to this report last month, and we’ll link it again, because it goes to our point about truth #3. Investors are looking to residential property even more than they are gold for a safe haven investment. The linked report is from Knight Frank, Douglas Elliman’s global partner. It is extremely detailed. We’d also note from that report, that sunbelt areas are popular destinations, especially if they are resort destinations. Mix in some seriously pent-up demand for foreign investment in U.S. real estate and you have some potential demand growth coming down the road.

Here’s the latest cash vs. loan breakdown. Cash is up again. It might go down again due to the low rates we saw in March. Imagine coming from the other side of the planet with all of the money you had planned on investing during the pandemic, but couldn’t and you’ll see why I continue to look at this bit of data.

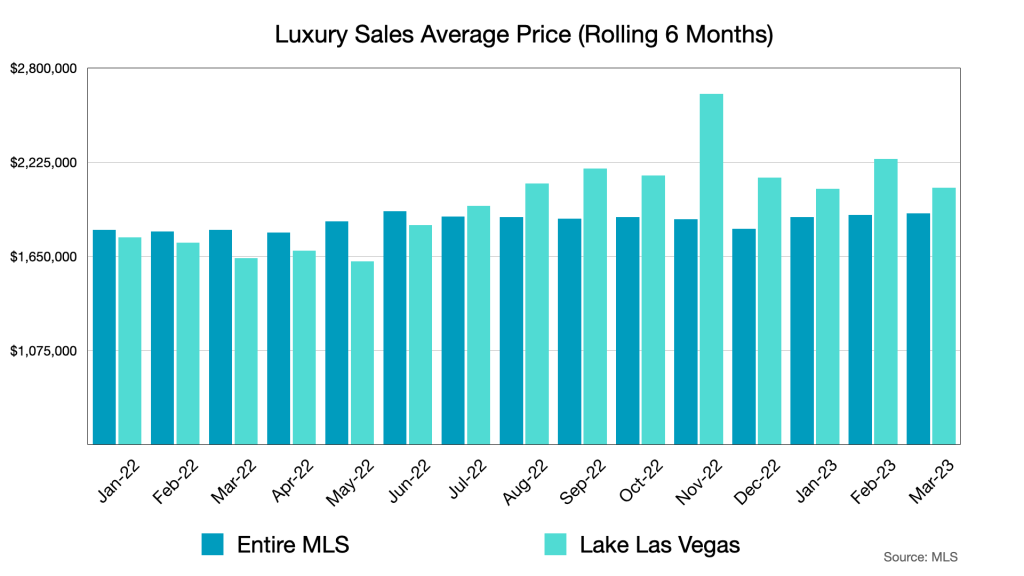

Now consider truth #1 from above. There are luxury ($1MM+) homes across the valley, but not all of them have a lake. Lake Las Vegas has not always performed this well in the luxury market for reasons that are hard to pin down sometimes. Properties on water are attractive to luxury buyers, and therefore to luxury investors. Throw in golf and resort amenities and you have a recipe for a great luxury community worthy of investment.

For more Lake Las Vegas real estate market data, click on the button below to access our dashboard.

Final Thoughts

We are seeing modest listing and buying activity. Will we see a sudden surge in investor activity? Probably not sudden, but it is something to watch. If Jay Powell does anything to Fed rates, just know there are about a million people who’ve been watching him to see how he eats a ham sandwich in case it is informative on his larger market and banking philosophies. Big bites, small bites, we’ll see, but we don’t think the rate changes will be much of a psychological shock to the market going forward, if anything, there is potential for less aggressive Fed action, if not outright cuts by the end of 2023.

We invite you to leave your thoughts in the comments below.

Thank you,

Robin & Dave

Sign up for our monthly newsletter below.

Your message has been sent