2023 in Review

January 2024 Report

2023 Year in Review

This past year has seen relative stability in the market. Although the 2022 interest rate hikes caused some turbulence, Lake Las Vegas weathered the storm. We’ll take a look at 2023 to see just how we weathered that storm.

Lake Las Vegas by the Numbers

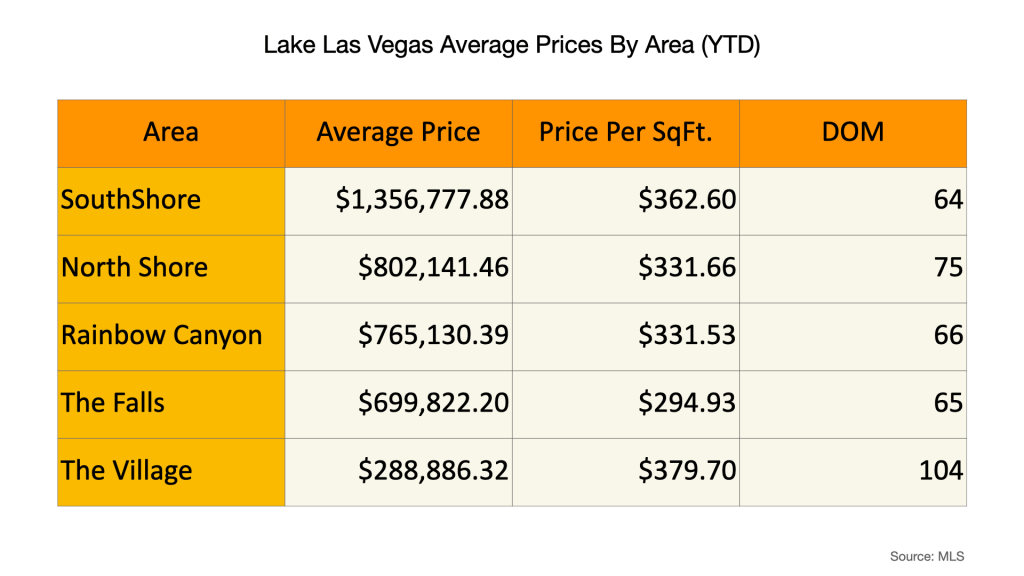

Here are the five areas of Lake Las Vegas broken down by average price, Price per square foot and days on market (DOM). Please keep in mind these areas each have a diverse inventory so some communities performed differently than their broader areas.

These communities are not all perfectly homogenous, especially South Shore and other custom home communities like The Estates. Larger homes might bring in a higher net price, but a lower price per square foot. If you want to dive into these numbers feel free to play around in our interactive dashboard.

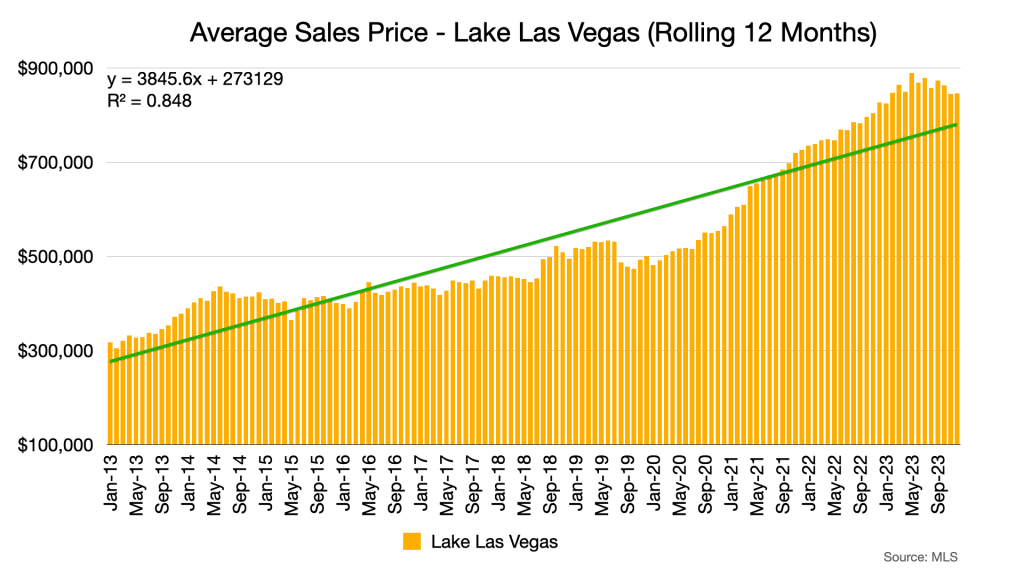

First, let’s take a moment to gain perspective on the long term, because real estate is a long term investment. This chart is ten years of data showing a rolling 12 months average to smooth out some of the seasonal volatility. We’ve come a long way as you can see. I remember seeing listings in SouthShore that were selling for almost $500k in 2012/2013 that are now worth north of $1MM. As you can see the growth rate was fairly slow until 2020. We’ll zoom in on this chart below to explore it in recent context.

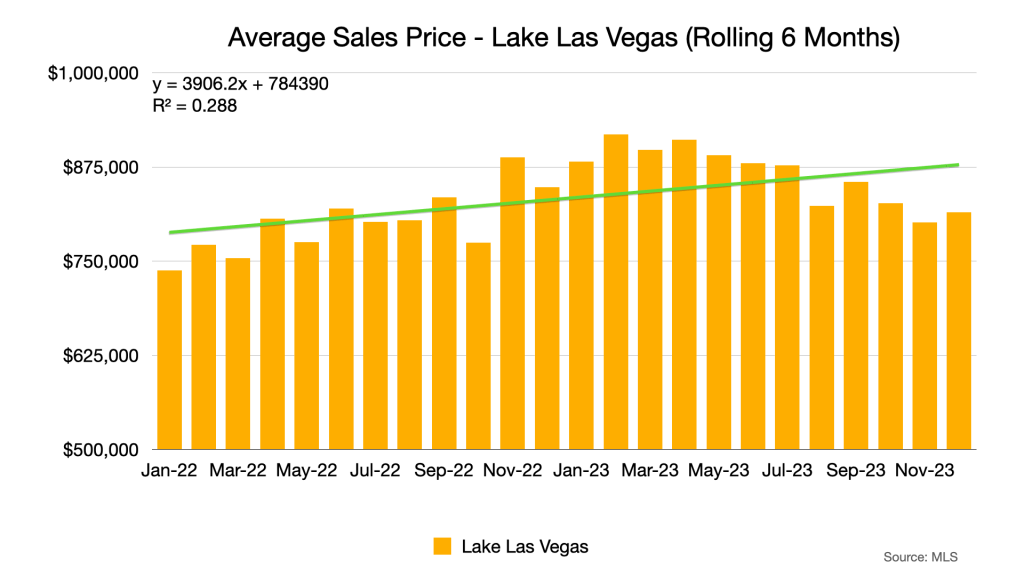

Now we zoom in to the last couple of years. The trajectory is still upwards. Note that each bar is a rolling 6 months of sales. If you were to look at the six months of sales one bar contains, you would see some extreme volatility. Volatility is not the state of the market, it is better to describe it as natural variability.

2023 seems to have offered a bit of a cooling off from the frenzied growth of the prior few years.

Sign up for our monthly newsletter below.

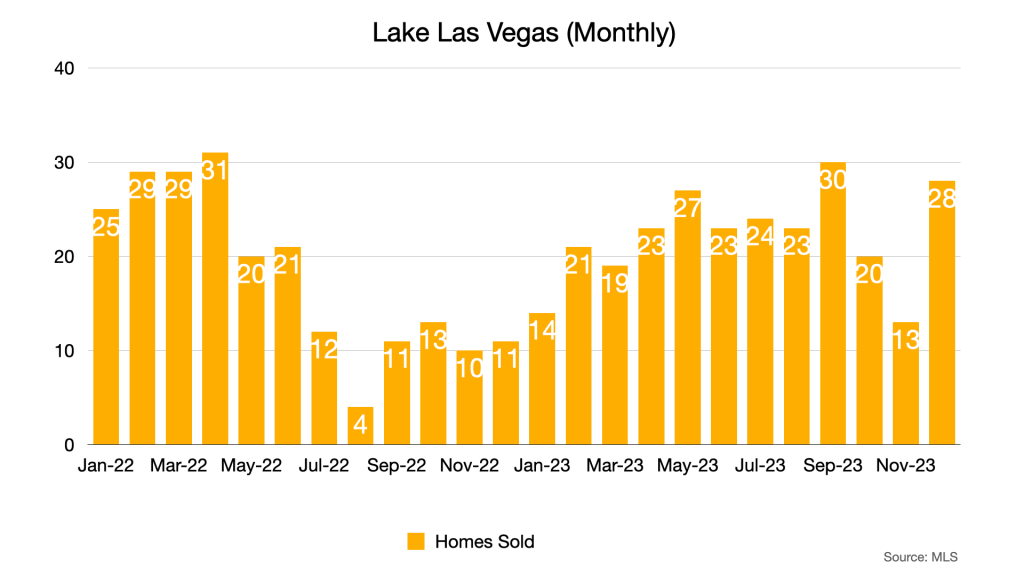

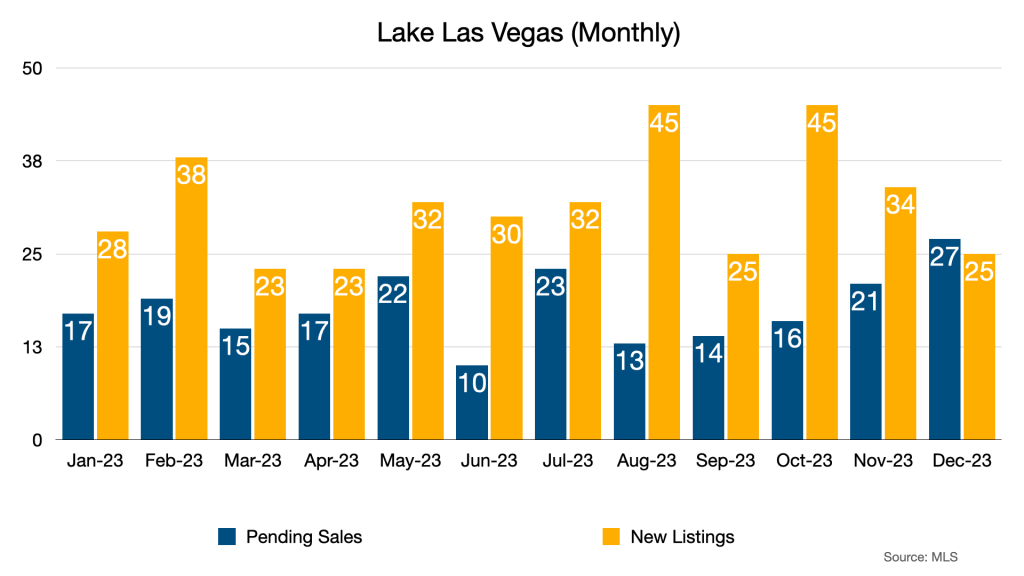

December 2023 saw a nice spike in sales. This is a great way to head into 2024. Although Spring may bring more listings, having a decent selloff to ring in 2024 helps keep the inventory from piling up during the slower winter months.

And here is some additional good news for year end. For the first time in 2023, we see pending sales for December above new listings. These pending sales will likely close sometime in January or very early February, which could give us yet another inventory reduction as we head into a year that may well see lower interest rates due to Fed activity.

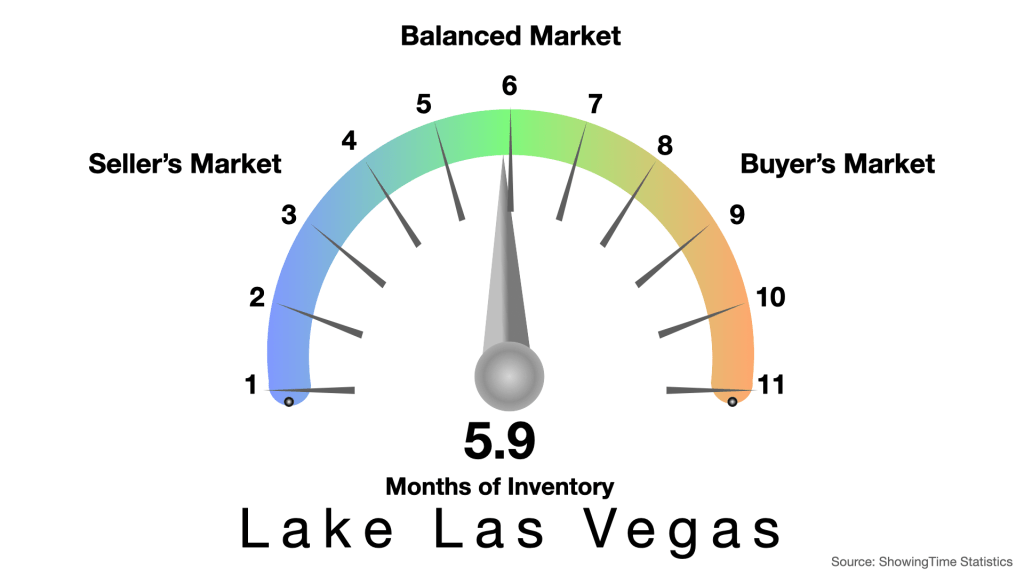

All of the sales and pending sales above come into play here. This is a good balanced market and for Lake Las Vegas, this is relatively low inventory. Buyers still have room to negotiate in this market, but sellers have some pricing power as well. Keep in mind this is for all of Lake Las Vegas. Inventory is highly local. Some communities and areas of Lake Las Vegas perform differently than others.

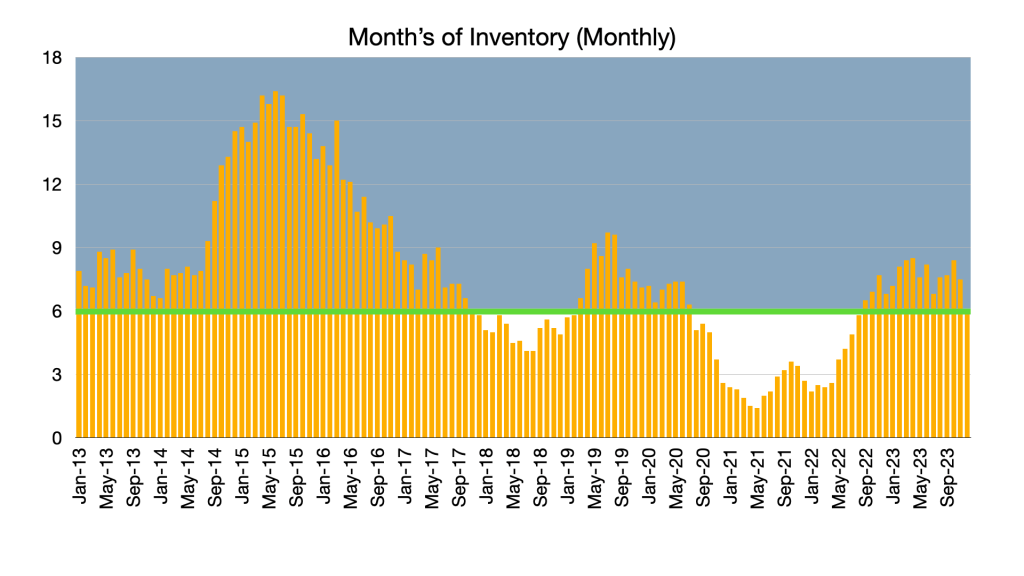

This is 10 years of monthly inventory for Lake Las Vegas to offer perspective. The blue area represents inventory above 6 months. Although inventory has accumulated starting in the second half of 2022 and through 2023, we are not too far off from where we usually are. Although each bar represents a month of activity, the calculation for this number is the number of homes for sale at the end of a month, divided by the average monthly pending sales from the last 12 months.

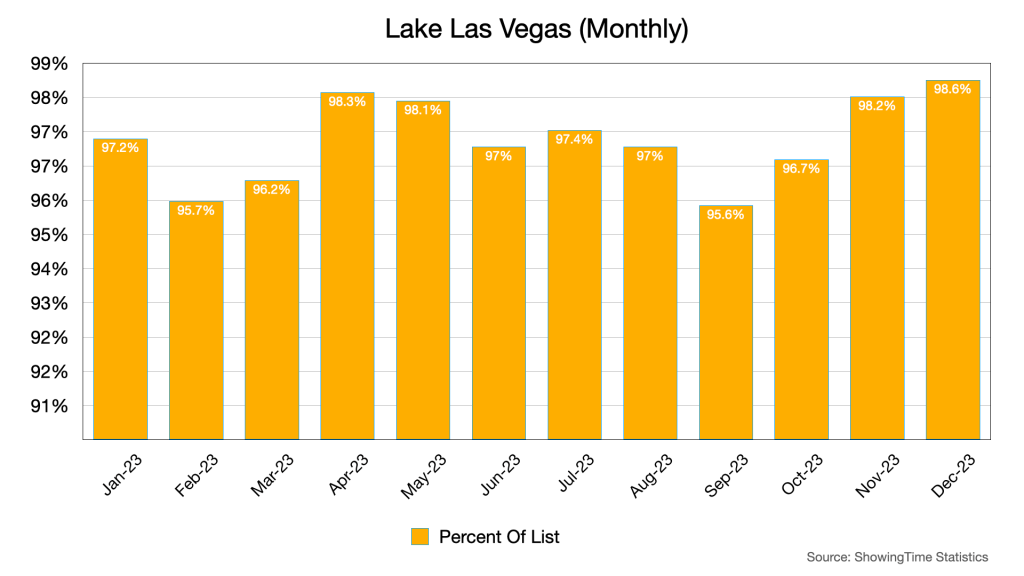

Two things are happening here. First, there is some competition in the market as evidenced by the sales activity mentioned above. Second, prices have adapted to the market a bit. Anecdotally speaking, we haven’t seen a lot of price reductions come through our activity feed. Average prices are lower though, so there is some competitive pricing going on out there.

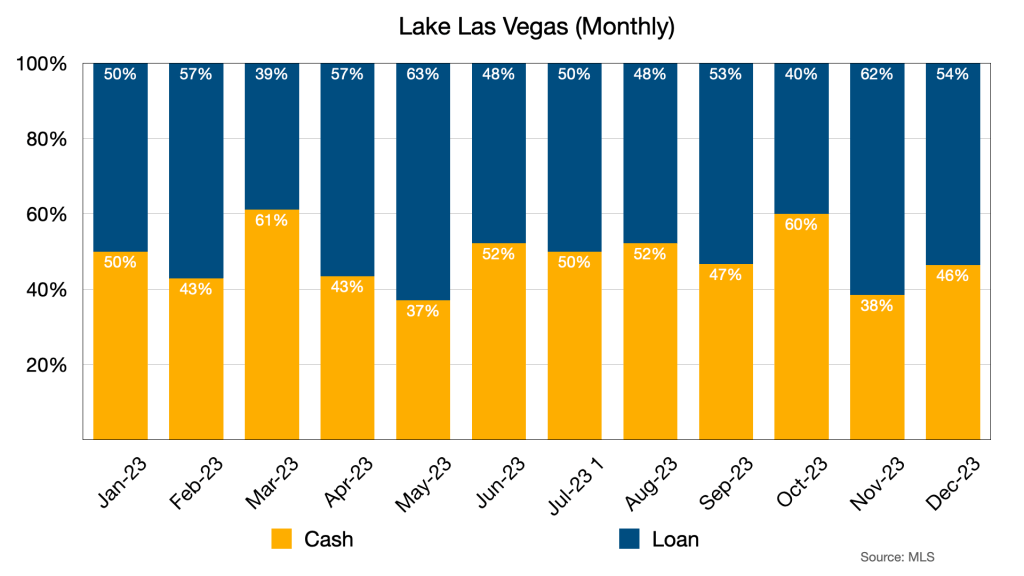

If interest rates continue to go down and stay down from their highs earlier in the year, we may see more loan purchases. The 2024 maximum conforming loan rate for Clark County Nevada is going up from $726,200 to $766,550 which brings more homes into the loanable range.

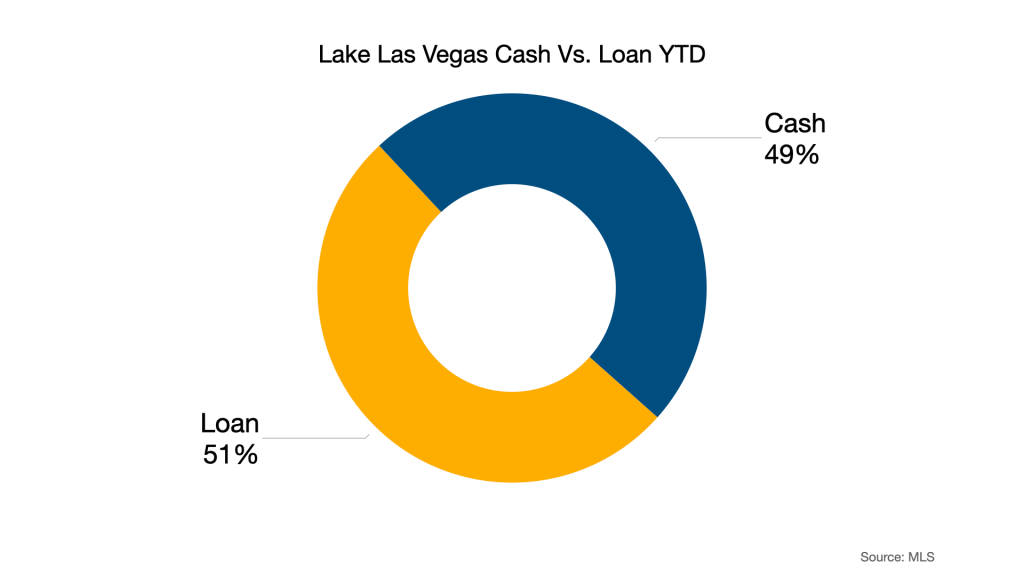

For 2023, Lake Las Vegas balanced out at 49% Cash to 51% Loan. I will, however, point out that many loan buyers likely put in a substantial cash down payment to cover the gap between the max loan amount and the price of the home, not to mention to reduce their interest rate. Since we cannot see the exact terms of each loan, we do not know how much actual cash was used in these loan transactions.

Interest rates are expected to go down somewhat in 2024. This is partially due to indications from the Fed that they are not planning any rate hikes and may be making some cuts. This website does a good job of tracking mortgage rates and applications. They also offer quite a bit of useful commentary. If cuts are made, and cuts are expected, we may see more of those loan buyers making offers here at the lake.

Final Thoughts

The past year has offered a good insight into how resilient the Lake Las Vegas real estate market is. The short term experience of market corrections and changes are always colored a bit by our experience of the past. In short, new information does not take root in the mind as quickly as that new information emerges. Price adjustments happen and the market adapts slowly because transactions take time to close. Buyers and sellers adapt, they shed the uncertainty that held them back from taking action because they have seen the resiliency of the market even if that notion was only realized in the subconscious.

The market shock of a rapid jump in interest rates lingered. Buyers were more acutely aware of the interest rate hikes than sellers might have been, but remember, sellers are usually buyers too. They need to move somewhere. Inventory spiked because demand dropped, not because there was a sudden need to liquidate home equity. But then the invisible hand of the market nudged prices down. In this case, the part of the Invisible Hand was played by lower demand.

We also learned that although the national real estate market can be analyzed as a whole, real estate is a highly localized market. Nevada received a continuous influx of new residents from California. Searches for real estate in Las Vegas and Lake Las Vegas originated from Los Angeles and surrounding areas in large enough numbers for the Google machine to take note. These buyers all came from a completely different market. They came in with plenty of cash and we could see that in the data. Cash buyers bought homes in all price ranges here in Lake Las Vegas. Cash was an important part of our resiliency.

The coming year holds some potential for an uptick in buying and possibly selling. I don’t see any reason why selling activity should increase too much as there are no apparent economic factors that are forcing home owners to sell. I suppose some sellers could be waiting on the sidelines hoping for lower interest rates to not only boost their home value through greater buyer demand, but to also loosen the golden handcuffs of their current low interest mortgage a bit so they can buy elsewhere without feeling like they surrendered a fantastic financial situation. But those sellers are likely very few and far between. Most people don’t make a decision to move purely on those types of subtle economic concerns, they do so because they need or want to move for personal or work related reasons. My point is, inventory is not likely to go up much in the coming year unless some sort of drastic economic circumstance forces people to sell. If inventory stays relatively the same or even spikes a bit, and demand grows due to improved purchasing power, we may see some home prices stabilize or even go up. I’m not going to predict a home price boom here, because we’re all a bit beholden to a few folks down at the Fed, but the ingredients for a decent lift in home values seem to be on the table for 2024.

Thank you,

Robin & Dave

Sign up for our monthly newsletter below.

One thought on “Lake Las Vegas Market Update”