A Deep Dive Into Understanding Home Values

Presented By: Robin & Dave

It’s been a while since our last Lake Las Vegas Market Report, but we’ve been busy upgrading our reporting system. Now, we can analyze the market in greater depth—spotting trends more easily and uncovering insights to help buyers and sellers make smarter decisions. In this update and in future updates, we’ll take a closer look at the data at a community level, starting with one of Lake Las Vegas’s most sought-after neighborhoods: Bella Fiore.

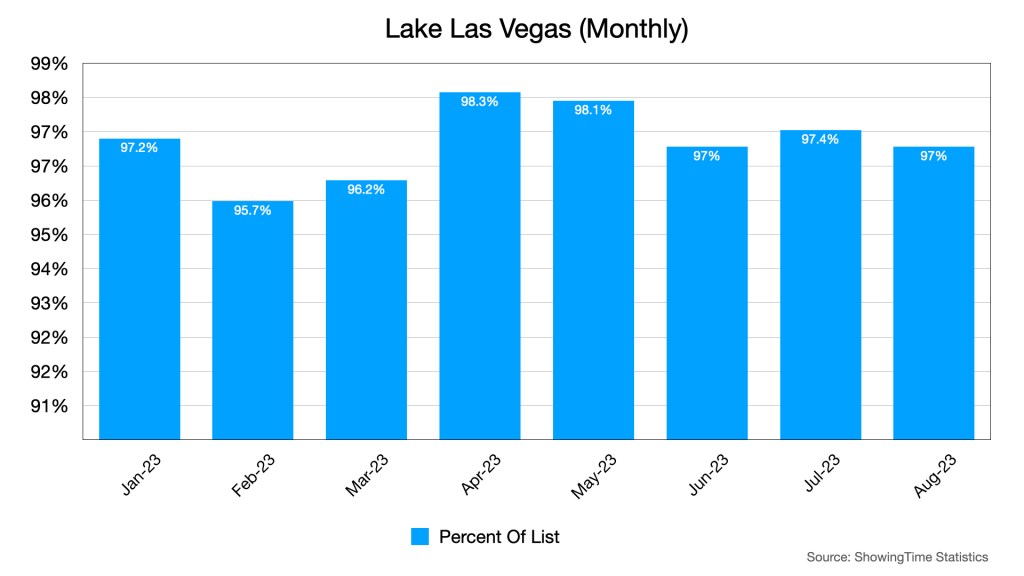

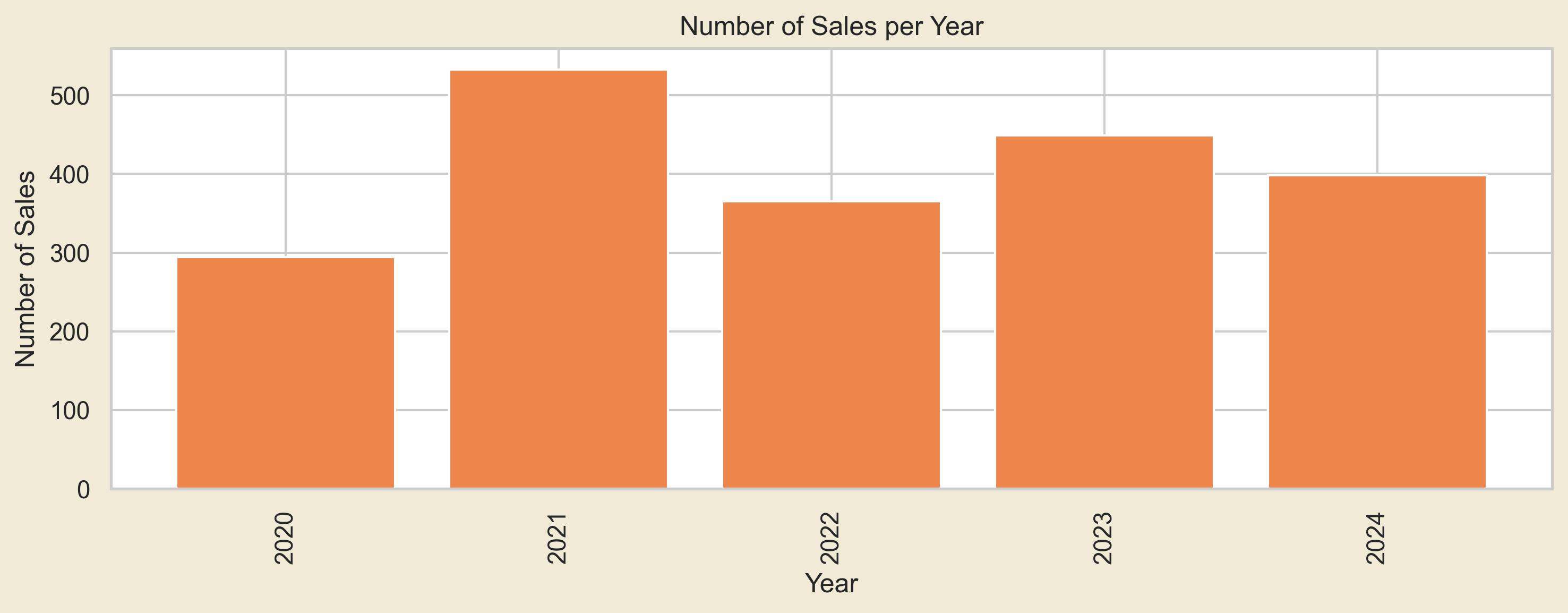

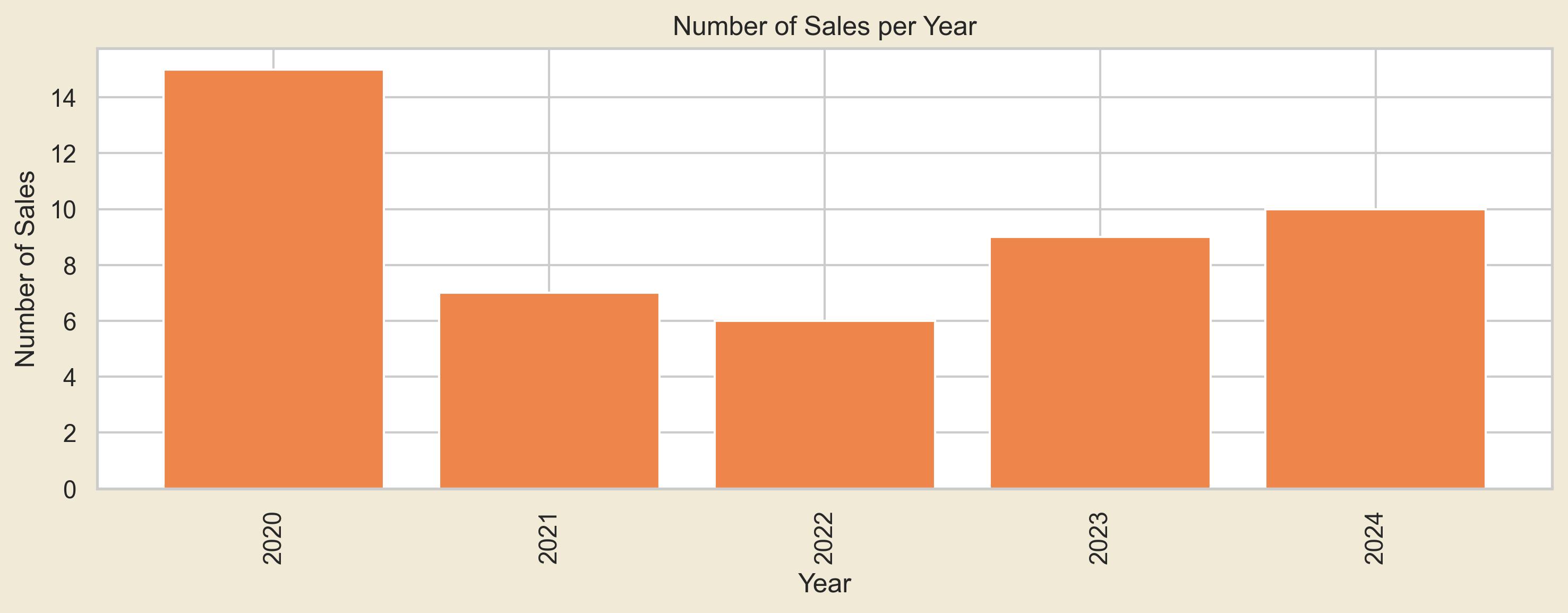

Before diving into the details, here’s a quick recap of the last few years.

2020 – 2024 Lake Las Vegas Sales

As shown above, the market has experienced a relatively stable sales period during the early 2020s. One key change in our new reporting system is that we now rely on tax records rather than solely on MLS data. This switch allows us to:

• Capture Private Sales: Include private transactions not listed on the MLS.

• Include New Home Builder Sales: Record sales that often aren’t in the MLS.

• Ensure Up-to-Date Data: Maintain a single, current entry per property—avoiding duplication from intermediary sales.

• Benefit from Cleaner Data: Leverage the robust, consistent feature data available from tax records.

Why rebuild our system instead of using data from Zillow? While Zillow does provide real estate data, it operates as a “black box” regarding how Zestimates are calculated and lacks the local expertise developed from over a decade of experience in Lake Las Vegas. Let’s continue our overview of recent trends before delving into more detailed analyses.

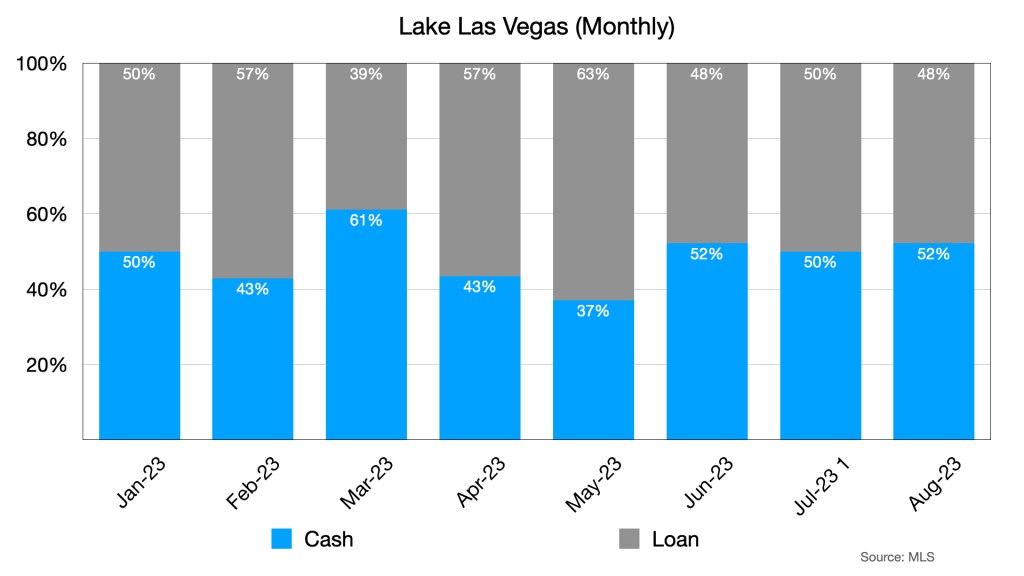

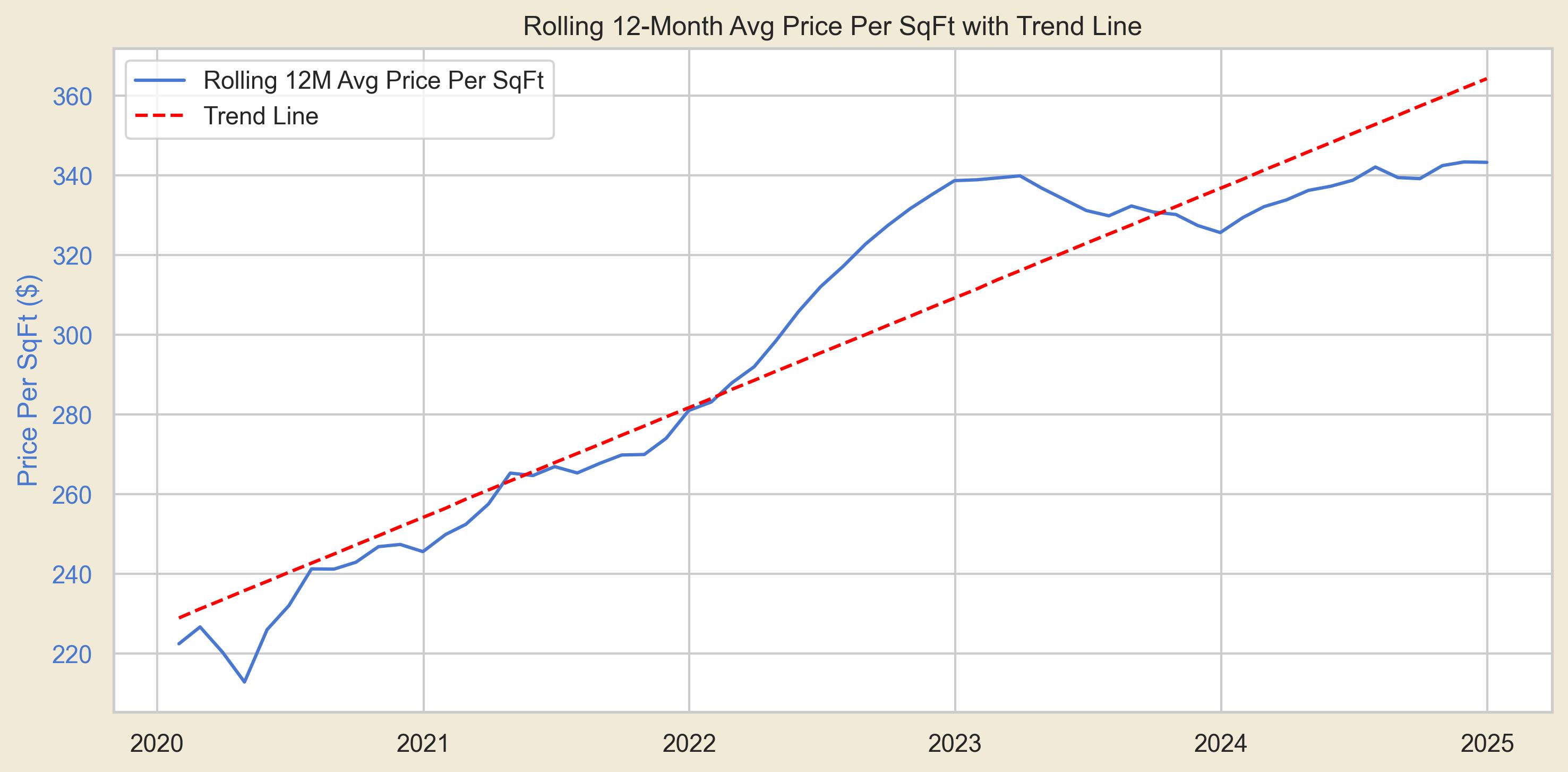

Compound Annual Growth Rate: 8.65%

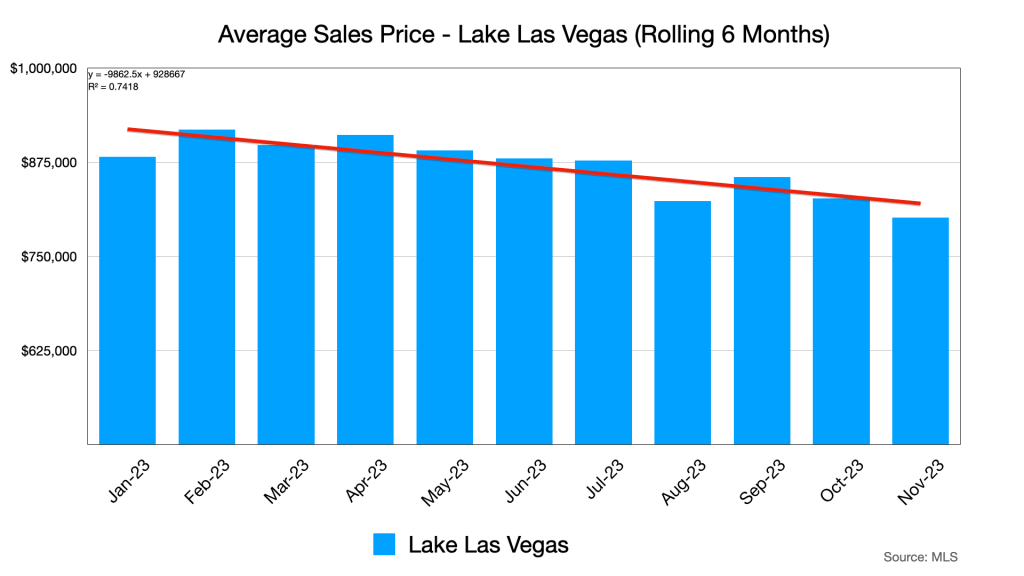

The line chart above shows the rolling 12-month average for price per square foot—based solely on the most recent tax record sale for each property, not every sale. From 2020 to 2023, the market saw a strong upward trend, with 2022 marking a particularly steep increase. However, interest rate hikes from late 2022 into 2023 pulled the market down from its peak of $340 per square foot, though recovery was evident by the end of 2024.

Remember that the $340 per square foot figure represents an average across all homes in Lake Las Vegas—from modest studio condos to expansive custom residences. While this overall number is informative, it doesn’t capture the unique characteristics of each community.

Below is a table showing the 2004 results for all communities:

| Community | Sales Count | Average Price | Average Price Per SqFt |

|---|---|---|---|

| Alta Fiore | 8 | $631,250.00 | $262.15 |

| Amberock | 6 | $525,165.00 | $305.29 |

| Armano | 1 | $605,000.00 | $280.35 |

| Barcelona | 1 | $1,850,000.00 | $460.43 |

| Bella Fiore | 10 | $1,005,200.00 | $323.61 |

| Bella Strada | 26 | $1,442,321.00 | $441.85 |

| Bella Vivente | 6 | $1,270,000.00 | $464.56 |

| Bellano | 6 | $633,233.33 | $341.80 |

| Biarritz | 3 | $3,438,227.67 | $618.58 |

| Caliza | 3 | $3,408,000.00 | $543.00 |

| Capri | 1 | $2,388,750.00 | $495.80 |

| Casa Palermo | 3 | $1,062,666.67 | $362.12 |

| Casa Villa Palermo | 3 | $569,000.00 | $295.39 |

| Del Webb | 68 | $662,251.76 | $329.97 |

| Golf Villas | 1 | $335,000.00 | $325.88 |

| Lago Vista | 3 | $1,441,666.67 | $374.24 |

| Luna Di Lusso | 11 | $214,218.18 | $400.59 |

| Mantova | 10 | $558,750.00 | $277.19 |

| Mantova Tennis Villas | 3 | $379,088.33 | $299.28 |

| Marbella | 6 | $910,310.17 | $358.93 |

| Marble Mesa | 19 | $626,508.37 | $310.92 |

| Marseilles | 1 | $4,705,000.00 | $548.75 |

| Mira Monte | 2 | $1,802,450.00 | $575.85 |

| Monaco | 1 | $1,150,000.00 | $275.52 |

| Monte Lucca | 4 | $1,078,000.00 | $388.61 |

| Parker Point Estates | 3 | $3,811,000.00 | $680.60 |

| Porto Villaggio | 1 | $1,850,000.00 | $528.72 |

| Portocielo | 8 | $883,750.00 | $316.42 |

| Portofino | 27 | $826,355.04 | $328.43 |

| Ravello | 1 | $1,000,000.00 | $500.50 |

| Regatta Heights | 7 | $971,285.71 | $335.69 |

| Regatta Pointe | 3 | $585,000.00 | $262.10 |

| Reverie | 21 | $728,495.95 | $295.89 |

| Shoreline | 2 | $2,136,500.00 | $636.93 |

| Siena | 1 | $3,600,000.00 | $638.41 |

| Sorrento | 4 | $1,231,250.00 | $338.81 |

| The Bluffs I | 19 | $498,754.21 | $283.16 |

| The Bluffs II | 19 | $592,370.84 | $274.11 |

| The Outlook | 6 | $1,065,750.00 | $418.60 |

| The Peaks | 7 | $1,083,857.14 | $333.19 |

| Tramonto | 7 | $659,285.71 | $272.68 |

| Tremezzo | 1 | $1,350,000.00 | $456.08 |

| V at Lake Las Vegas | 12 | $449,118.17 | $305.76 |

| Vantage | 4 | $2,234,375.00 | $575.48 |

| Varenna | 2 | $795,000.00 | $309.18 |

| Viera | 16 | $261,881.25 | $365.44 |

| Vila Di Lago | 3 | $809,666.67 | $335.27 |

| Vila Di Lago Condos | 3 | $397,666.67 | $240.05 |

| Villa Palermo (North) | 4 | $503,500.00 | $317.25 |

| Villa Palermo (South) | 4 | $503,500.00 | $303.20 |

| Vita Bella | 7 | $526,419.57 | $290.41 |

The table above provides context for the time series chart, allowing you to see how each community in Lake Las Vegas compares. Note that some communities have only one or two sales, and while we could expand this table to include multiple years, doing so might make the data less reflective of current market conditions.

Let’s focus in on Bella Fiore. First, let’s get perspective on the first half of the 2020s.

Bella Fiore 2020 – 2024

Compound Annual Growth Rate: 9.48%

This trend aligns with Lake Las Vegas’s overall performance, showing a slightly higher CAGR. Bella Fiore peaked around $319 per square foot before dipping in late 2023. With fewer annual sales, broader market trends may be less apparent due to time lags between transactions.

Examining broad price trends provides a useful baseline, but a deeper dive into the details is essential for truly understanding the Lake Las Vegas real estate market. Let’s explore our feature analysis.

Feature Analysis

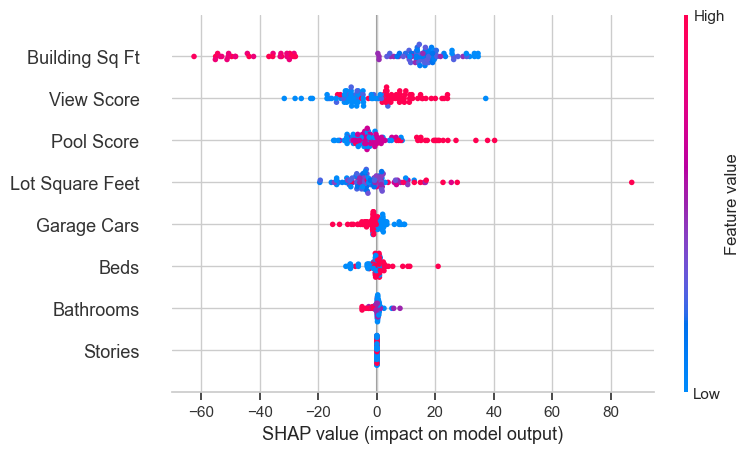

Our upgraded reporting system also incorporates advanced machine learning algorithms that deliver deep insights into the features that drive price per square foot in Lake Las Vegas. Below is the feature importance plot for Single Family Homes—drawing on data from 1997 to the present, which captures extensive detail on nearly every home.

Feature Importance for Single Family Homes in Lake Las Vegas (All Time)

It’s clear that views play a significant role in Lake Las Vegas. When reviewing the community table above, keep in mind that while some communities include these premium features, the limited number of sales in a given area may not fully capture their impact on the average price per square foot.

Why Use Price Per Square Foot Instead of Sales Price?

Sales prices in Lake Las Vegas vary widely, as shown in the community table. Larger homes naturally cost more, which means size tends to dominate the feature space when comparing raw sales prices. This makes it difficult to isolate the impact of other factors.

For example, both a $2 million custom home and a $700,000 home can have a pool—so how do you determine whether the pool is influencing the price? Using price per square foot helps reduce the noise caused by extreme price differences, making it easier to assess the effect of individual features.

That said, price per square foot isn’t perfect. Some variability remains, particularly with home size. For instance, in certain communities, smaller homes tend to have a higher price per square foot than larger homes. This overlaps with the “Stories” category—two-story homes are often less desirable to certain buyers, but they also tend to be larger. Despite these complexities, the feature importance chart above offers additional clarity.

Larger homes often have a lower price per square foot than smaller homes because not all space is equally valuable. High-cost areas like kitchens and bathrooms carry similar expenses regardless of home size, while additional living spaces typically add less value.

Let’s take a closer look at the Bella Fiore homes to explore their features.

Bella Fiore Features (All Time)

This dataset includes the most recent sale for nearly every home in Bella Fiore—109 in total. As seen in the chart, Building SqFt is the dominant factor, with larger homes (red dots) lowering price per square foot and smaller homes (blue dots) increasing it. Stories, however, ranks low in influence.

Bella Fiore has a handful of distinct floor plans, with larger homes typically being two-story. In some Lake Las Vegas communities, two-story homes are preferred for their elevated views. However, Bella Fiore’s best views are along the outer edges, making elevation less relevant.

This analysis highlights key factors but excludes interior design features like flooring, countertops, and appliances, which are difficult to capture consistently. While these elements do impact value, assessing them requires an in-person visit—something beyond the scope of this dataset.

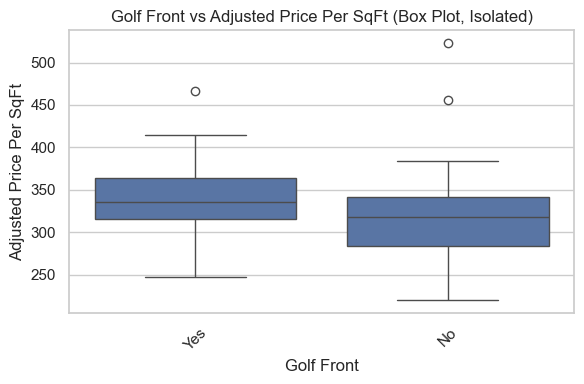

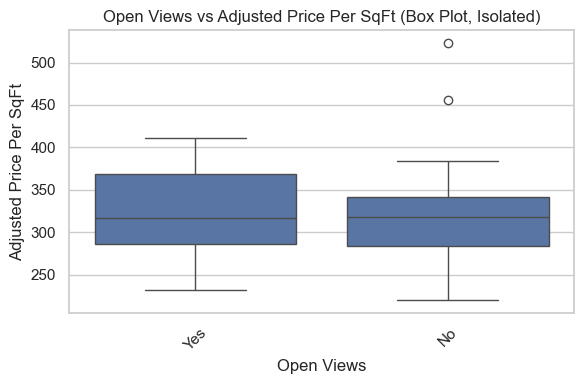

Now that we have a bird’s-eye view of Bella Fiore, let’s take a closer look. View Score and Pool Score are composite features derived from more detailed view and pool data. Our proprietary view data is the result of extensive research, local expertise, and countless hours analyzing listing photos. The charts below compare features and price per square foot.

We begin by examining the View Score feature in detail. Since its meaning isn’t immediately clear, we break it down by view types. Globally, Strip Views and Golf Front Views are weighted equally, while Open Views carry a lower weight.

View Definitions:

• Lake View: The property offers a clear view of Lake Las Vegas from at least one vantage point.

• Golf Front: The property directly borders a golf hole or a well-maintained green space—similar to the manicured area at The Falls.

• Open Views: The home provides unobstructed views of the surrounding area, though without a distinct landmark.

• Strip View: The property affords a decent view of the Las Vegas Strip, or part of it, from a suitable angle.

• On Lake: The home sits directly on the lakefront with no intervening properties or obstructions.

Note that properties with “Open Views” are considerably fewer in Bella Fiore compared to other view types, so this final plot may be less representative.

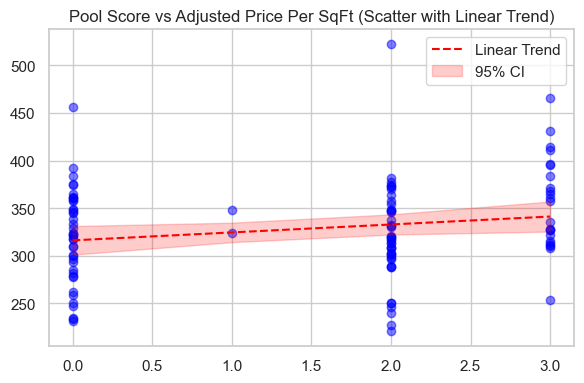

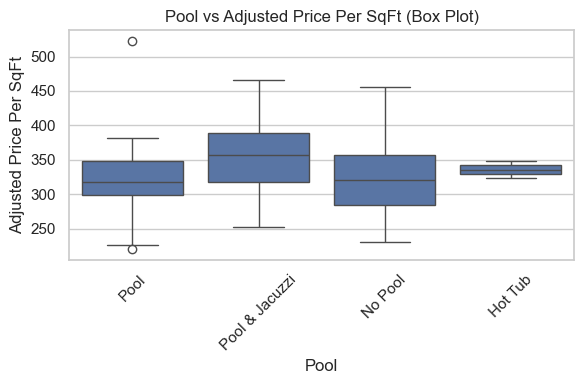

Now let’s examine pools. We see that pools are significant in Bella Fiore, but which types matter most? The box plot below draws on tax records for each home, so the pool categories are straightforward.

All values are adjusted to reflect current conditions. Overall, properties with pools—whether a simple pool or a pool and jacuzzi—tend to reach higher pricing levels than those without pools. While there is some overlap in price ranges, homes offering a pool amenity generally command a premium, reflecting buyer interest in added recreational features.

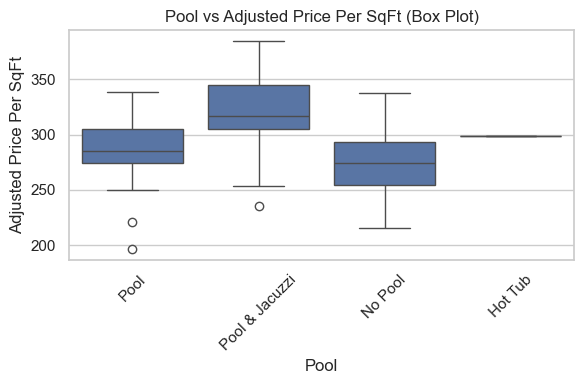

While these plots span 2006 to the present, focusing on 2020–2024 shows pools have a stronger impact on price in recent years. With higher installation costs and longer wait times, buyers appear more inclined to pay a premium for a home that already includes a pool.

Pools All Time

Pools 2020 – 2024

Now, we have a clear picture of how each feature influences price per square foot. While much of this aligns with intuition—such as a home with a view being more valuable than one without—quantifying these factors provides a more precise analysis beyond gut instincts.

Wrapping Up

In conclusion, our enhanced reporting system provides a detailed, data-driven snapshot of the Lake Las Vegas market. By integrating tax records, advanced machine learning, and nuanced analyses of key features—like view and pool scores—we’ve uncovered insights that move beyond traditional intuition. This comprehensive approach not only highlights trends in communities like Bella Fiore but also empowers buyers and sellers with actionable intelligence. As the market evolves, our commitment remains to deliver clarity and precision, ensuring you stay informed and ahead of the curve.

Subscribe to our newsletter for exclusive insights and updates on the Lake Las Vegas market.

1700 S PAVILION CENTER DR, STE 150

LAS VEGAS, NV 89135

David Foresi lic# S.0176578

Robin Foresi lic# S.0176572